13358348478

關(guān)于我們VIEW MORE

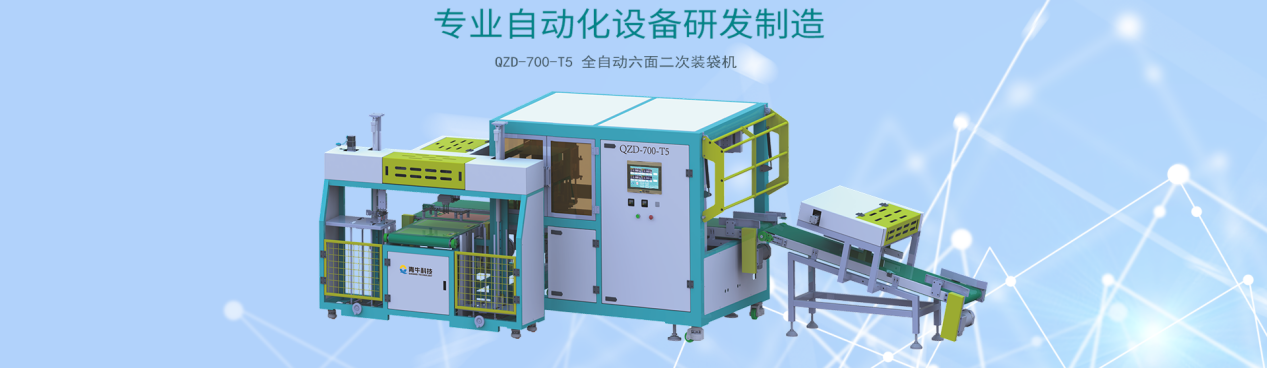

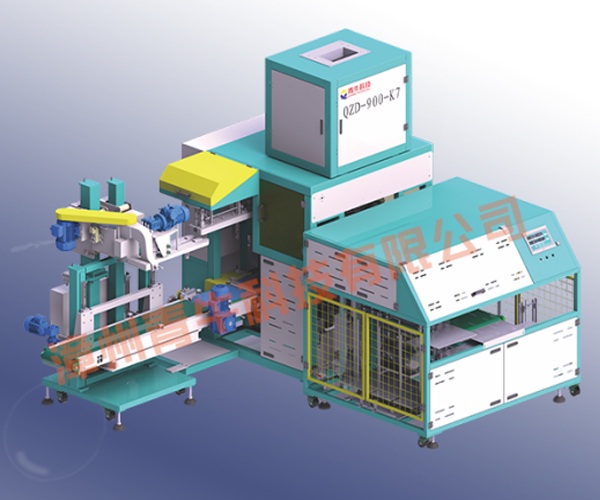

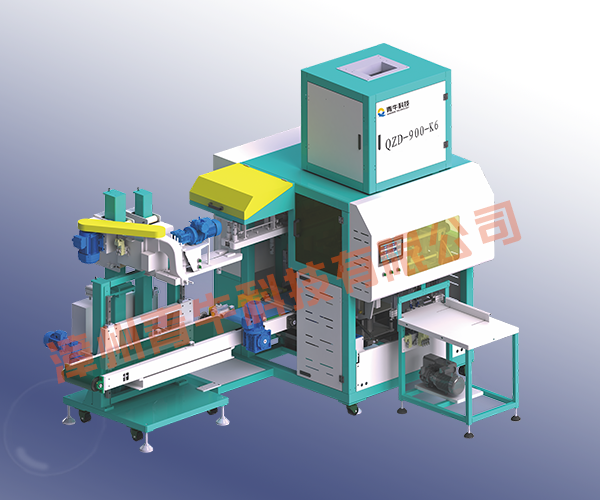

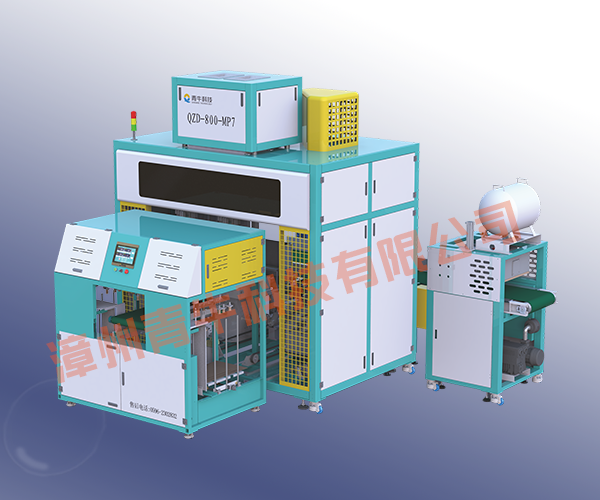

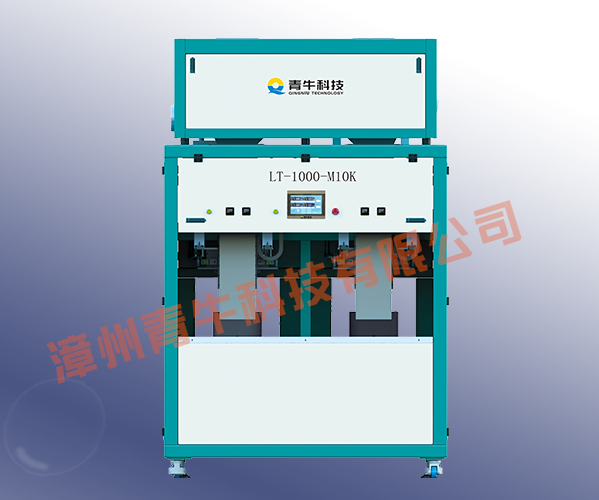

漳州青牛科技有限公司系國(guó)家高新技術(shù)企業(yè),擁有一批長(zhǎng)期從事自動(dòng)計(jì)量包裝設(shè)備的專(zhuān)業(yè)工程技術(shù)人員,致力于打造良好全自動(dòng)包裝機(jī)械。公司專(zhuān)業(yè)從事計(jì)量稱(chēng)重、自動(dòng)真空包裝設(shè)備、袋中袋自動(dòng)二次包裝系統(tǒng)、自動(dòng)開(kāi)箱裝箱、機(jī)器人碼垛等自動(dòng)化設(shè)備研發(fā)制造的企業(yè)。

公司立足于國(guó)內(nèi)外農(nóng)副產(chǎn)品加工領(lǐng)域,是國(guó)內(nèi)大米加工行業(yè)自動(dòng)化、智能化、現(xiàn)代化包裝的倡導(dǎo)者。目前公司已申請(qǐng)專(zhuān)利47項(xiàng),其中發(fā)明專(zhuān)利7項(xiàng),實(shí)用新型專(zhuān)利40項(xiàng)。

漳州青牛科技有限公司位于田園都市福建省漳州市,交通便利。青牛將堅(jiān)持“創(chuàng)新、品質(zhì)、卓絕、共贏(yíng)”的理念,用良好的產(chǎn)品、成熟的行業(yè)經(jīng)驗(yàn)為海內(nèi)外客戶(hù)提供自動(dòng)化包裝整體解決方案,贏(yíng)得客戶(hù)信任和更多的合作。

因?yàn)閷?zhuān)注,所以專(zhuān)業(yè),漳州青??萍加邢薰緦?zhuān)注包裝領(lǐng)域、創(chuàng)造包裝精品、不斷致力于智能化包裝設(shè)備的研發(fā)制造,以更智能、高能、可靠的產(chǎn)品來(lái)滿(mǎn)足日新月異的市場(chǎng)需求。力爭(zhēng)成為國(guó)內(nèi)包裝自動(dòng)化技術(shù)的領(lǐng)頭者,為我國(guó)包裝自動(dòng)化事業(yè)添磚加瓦。

新聞資訊VIEW MORE